Gaishi Automotive Information Express, April 12, 2024, 16:51, Shanghai

In 2023, China’s passenger car market further intensified its shift towards electrification, with the sales of electrified passenger cars reaching 9.836 million units, and the electrification penetration rate reaching 37.8%. The powertrain formats of PHEV and REEV have become the main contributors to market growth. Looking ahead to 2024, we believe that with the support of 800V high voltage, SiC (silicon carbide), and high-rate battery technologies, high voltage and super-fast charging technologies are expected to gradually enter the mainstream market. At the same time, the continuous iteration of hybrid technology will optimize fuel economy, and the plug-in hybrid market will also maintain rapid growth.

Key points of the report include:

Current State of the Passenger Car Electrification Market: NEV market maintains rapid development, while the HEV market shows weak growth.

- Industry goals and policies: In 2023, there is still pressure on core technical indicators compared to the 2025 targets, notably the hybrid’s share in traditional passenger cars is 18.8%, far from the target of 50% to 60%. In terms of policies, seven national ministries have jointly issued documents to ensure the stable and positive development of the automotive industry, with new energy vehicle purchase tax incentives extended to 2027.

- Current state of the electrification market: In terms of powertrain formats, the pure electric market is maintaining growth in structural adjustments, with the plug-in market growing by 86% year-on-year, while HEV growth is weak. Among them, the electrification penetration rate of domestic automakers is significantly higher than that of foreign automakers, with domestic companies accelerating their transition to electrification, and joint venture companies Toyota HEV and BMW NEV have a relatively leading position in market penetration.

Analysis of the Core Components Market for Electrification: 800V high voltage + SiC + high-rate battery technology accelerates the transformation of the automotive market.

- Power battery: In 2023, the total installed capacity of power batteries exceeded 387.7GWh, with lithium iron phosphate batteries dominating the market with a 67.3% share due to their economic advantages. The concentration of the top 10 battery manufacturers reached 96.8%, and the power battery market showed a “dual leaders” competition pattern. The trend towards multiple suppliers for power battery systems is evident, while automakers are accelerating the research and production of their own cells, with 1-1.5C rates being the current mainstream and 2C and above models accounting for only 1.5%.

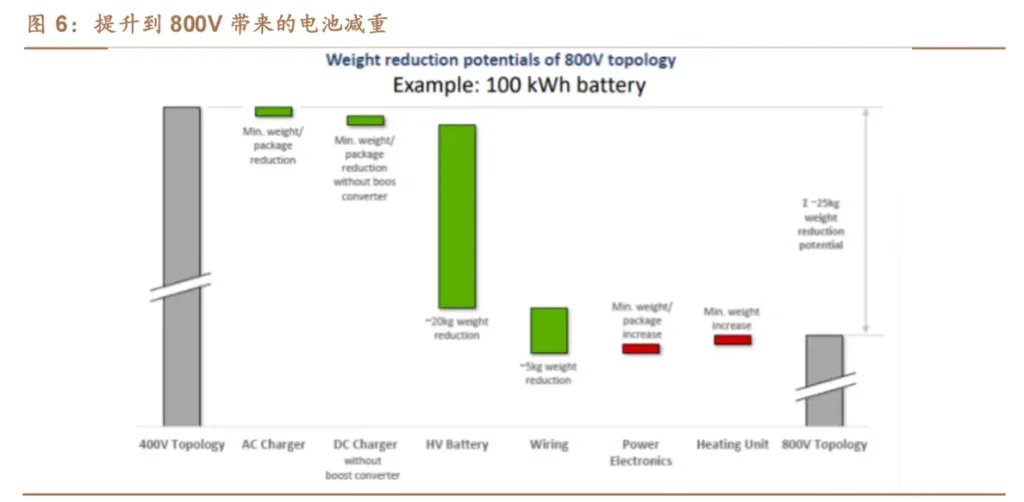

- Electric drive: The number of drive motors installed in new energy passenger cars exceeded 833.7 million units, with a concentration of the top 10 suppliers exceeding 70%, including four suppliers that are self-research and self-production by automakers, accounting for nearly 50%. The penetration rate of 800V high voltage platforms was only 4.4% for the full year, and the SiC penetration rate was only 11%. With the gradual maturity of the supercharging industry chain, costs are expected to further decline as scale increases.

- Power module: The power of onboard chargers (OBC) is mainly concentrated at 3.3kW and 6.6kW, with the 6.6kW version accounting for 54% of the market. Some companies have started to introduce 11kW and 22kW versions, and it is expected that onboard power modules will develop towards integration, high power, and bi-directional OBC. With the upgrade of the vehicle’s voltage, SiC-MOSFETs are accelerating the replacement of Si-IGBTs, and high-voltage connectors are also increasing. SiC devices can reduce losses and increase the OBC power density and system efficiency by about 1.5%-2.0%, and the overall upgrade to SiC could potentially increase the efficiency of the entire vehicle system by more than 5%.

2024 Industry Trends for Passenger Car Electrification: Expected annual cumulative electrification scale nears 12 million units, with a market penetration rate of 45%.

- The passenger car electrification market is expected to maintain rapid development trends, with plug-in hybrid and high-end pure electric markets being the main growth drivers. Components will also accelerate technological innovation and iteration, with the vehicle’s high-voltage platform mainly considering 400V/800V and full-range 800V options, evolving towards platformization, deep integration, cross-domain integration, and power domain modules. Innovative technologies such as lithium manganese iron phosphate and semi-solid are successively being mass-produced, and 800V high voltage and super-fast charging technologies are expected to enter the mainstream market. From the perspective of next

The current transition to electrification has entered a comprehensive market expansion phase, with the process of hybridization still falling short of the targets. It is necessary to strengthen policy guidance to promote the co-development of energy-saving vehicles and new energy vehicles. In 2023, national and local policies will continue to support the steady upward development of the automotive market, with the seven national ministries jointly issuing the “Stabilizing Growth Work Plan for the Automotive Industry (2023-2024)”. This will ensure that the automotive industry maintains a stable and positive development momentum. The policy of tax reduction for new energy vehicle purchases will be extended to the end of 2027, and new technical parameters will be adjusted and added, including a minimum electric range of 120 km and a battery system energy density of at least 95 Wh/kg.

In 2023, the sales of electrified passenger cars in China totaled 9.836 million units, with an electrification penetration rate of 37.8%. In terms of powertrain formats, pure electric vehicles maintained a rapid development level, while the HEV market showed weak growth. The share of PHEV+REEV continued to expand, mainly due to the iterative upgrades of domestic plug-in hybrid technologies, which offer advantages such as low energy consumption and high cost-effectiveness, better meeting the market’s current needs. These vehicles provide consumers with a driving experience without range anxiety and are more suitable for the diverse road conditions in China.

Looking at the new energy market, there is a clear structural adjustment towards a spindle-shaped pattern. In the pure electric field, the A00-level segment is rapidly declining, while A-class vehicles are seeing significant growth due to popular models like BYD and Aion. The plug-in hybrid market is benefiting from the explosion of extended range models like BYD DM-i, Li Auto, and Deep Blue, maintaining rapid growth. The penetration of new energy vehicles varies across different cities, with tier 3 and below cities still showing potential for development. In tier 1 and new tier 1 cities, the penetration rate is relatively leading at 45.3% and 38.1%, respectively, while the penetration rates in tier 2 and tier 3 cities are roughly in line with the overall penetration rate. Low-tier cities are relatively behind in their development process.

From the perspective of the core components of the “three electrical” system, the battery industry is moving towards a trend of multiple suppliers. At the same time, automakers are accelerating the research and production of their own cells, with domestic automakers generally introducing multiple suppliers. Major new energy brands such as XPeng, Li Auto, and Hozon have more dispersed suppliers, while brands like Li Auto, Tesla, and Seres mainly choose CATL as their main supplier. NIO has increased the proportion of cells from Zhongke Innovation, and it is expected that the subsequent power battery supply will mainly be a multi-supplier strategy.

In terms of material systems and average rates, the power batteries for new energy passenger cars in 2023 were mainly lithium iron phosphate, with ternary batteries dominating in the B-level and above markets, primarily with 1-1.5C rates. With the mass production of 4C batteries, the charging rate is expected to accelerate iterative upgrades in 2024.

Currently, the best combination of 800V voltage platform and SiC (silicon carbide) electric drive is accelerating its application. In 2023, the penetration rate of 800V high voltage platforms in new energy passenger cars was only 4.4%, and the penetration rate of SiC was only 11%. With the gradual maturity of the supercharging industry chain, costs are expected to further decrease, and the starting price is expected to drop below 200,000 yuan in 2024, accelerating the popularization of 800V technology and its penetration into the mainstream market.

Currently, the trend in onboard power modules is towards integration, high power, and bi-directional charging and discharging. The current status of onboard chargers (OBC) is mainly concentrated at 3.3kW and 6.6kW, with the 6.6kW version accounting for 54% of the market. Some companies have started to introduce 11kW and 22kW high-power OBCs, and it is expected that onboard power modules will develop towards integration, 11kW/22kW high power, and bi-directional OBCs. With the upgrade of the vehicle’s voltage